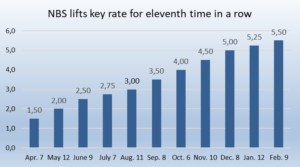

Serbia’s central bank (NBS) decided to increase its key repo rate by 25 basis points to 5.5% to counter inflationary pressures, it said on Thursday.

The central bank also raised the deposit facility rate and the lending facility rate by the same percentage, to 4.5% and 6.5%, respectively, it said in a statement.

Inflationary pressures on the global and domestic markets proved to be stronger and more persistent than previously expected, the NBS noted, adding that the trend requires further tightening of monetary policy.

The latest data published by the national statistical office showed that Serbia’s consumer prices increased by 15.1% year-on-year in December, after rising by the same rate the month before.

This is the eleventh time since April 2022 that the NBS has increased its policy rate, for a total of 450 basis points.

Source: SeeNews, Momentum