The first half of the year brought a challenging business environment for Serbian companies due to high inflation, increasing raw material, and energy prices, and still disrupted global supply chains. In such circumstances, some of the companies found themselves as absolute gainers, such as The Petroleum Industry of Serbia (NIIS) and Impol Seval (IMPL), as the aforementioned global factors harmed the business results of Messer Tehnogas (TGAS) and Metalac (MTLC).

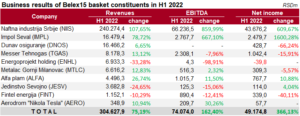

The aggregate revenues of Belex15 index constituents reached RSD 304.6bn, up 75.2%, primarily due to a more than doubled contribution of NIS thanks to the higher crude oil price and increased demand on the market. The total net income of the basket, due to NIS’s stellar performance also, jumped 4.7 times to RSD 49.2bn. Impel Seval also significantly contributed to the overall result of the index by using advantage of favorable market opportunities and achieved a record H1 net income of RSD 2.48bn.

On the other hand, insurer Dunav Osiguranje (DNOS) suffered a 66.2% drop in H1 profit due to higher costs in insurance claims. Tehnogas recorded a profit decrease of 16% due to a jump in electricity and raw materials prices. Gornji Milanovac-based Metalac, despite record business revenues, suffered a 5.6% drop in the bottom line due to rising material costs. Constructor Energoprojekt Holding (ENHL) was the single company that suffered an H1 net loss, while Belgrade Airport (AERO) turned a profit, on the wings of one-off revenues.

The Belex15 index has increased 3.3% since the beginning of the year, while the real investors’ yields are slightly higher, considering it has not been adjusted for dividends (tracking pure price performance).